& emsp; & emsp; 1. Introduction to the basic environment of India

& emsp; & emsp; India is the largest country in South Asia.The land area of 2.98 million square kilometers (excluding the China -India border India and the actual control zone of Kashmir India), ranking seventh in the world.The northeast of India is the same, Boman, the east is neighbor, the southeast is across the sea, and the northwestern part and the border.In the east, the Bay of Bangladesh and the Arabian Sea in the west, the coastline is about 8,000 kilometers long.So how is the Indian investment environment analysis report?What are the strategies for the environment?What are the environmental policies?The Silk Road Impression Investment Analysis of the Indian Ministry of India has analyzed the advantages and disadvantages and risks of the Indian investment environment in 2022 based on field research experience in the Indian market for many years.

& emsp; & emsp; India spans 2 time zones, namely East 5 and East 6th district.The capital New Delhi time is later than Beijing time

2.5 hours, no summer time.

& emsp; & emsp; According to the Silk Road Impression Investment Analysis of the Indian Division, the "Report of the Indian Investment Environment and Development Potential Report in the Era of the Extraction after 2022-2026" shows that India has rich resources, nearly 100, nearly 100

Planting minerals.Yunmu production is the world's number one, and coal and heavy crystal output are third in the world.As of the end of 2010, the main resource proven reserves were: 69,000 tons of Yunmu, 105.8 billion tons of coal, 34.31 million tons of heavy crystal stone, 850,000 tons of gold, 116 million tons of silver ore, 1.2 billion tons of oil, 14,370 natural gas, 14,370 natural gas

100 million cubic meters.In addition, there are plaster, diamonds and titanium, 钍, uranium and other minerals.India has a forest area of 678,000 square kilometers and a coverage rate of 20.64%.It has an area of 1.6 million square kilometers.In 2012, the output of Indian Heavy Stones, Talc / Leaf Stone was 1.739 million tons and 118.4

10,000 tons, accounting for 17.9%of global output, 15.2%, ranking second in global output.

& emsp; & emsp; 2. Investment attraction

& emsp; & emsp; From the perspective of the attraction of the investment environment, India's competitive advantage has the following aspects: relatively stable politics; good economic growth prospects; more than 1.2 billion people, huge market potential; superior geographical location, radiating the Middle East, East Africa, South Asia, South Asia, Southeast Asian market.

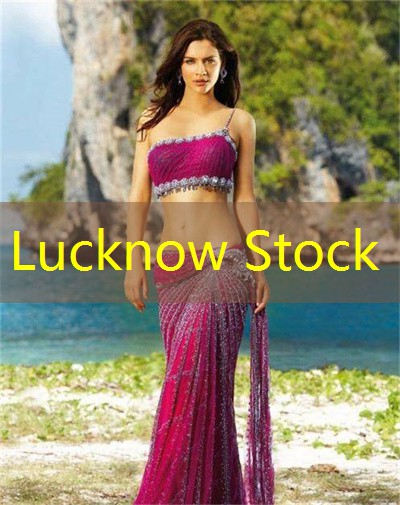

& emsp; & emsp; key/characteristic industry

& emsp; & emsp; [Agriculture] It has 1/10 arable land in the world with an area of about 160 million hectares and a per capita of 0.17 hectares. It is one of the world's largest food producers.Rural population accounts for 72%of the total population.The main grain crops include rice and wheat, and the main economic crops include oil, cotton, jaoseki, sugar cane, coffee, tea and rubber.Due to the weak investment and unreasonable use of fertilizers, agricultural development has been slow in recent years.During the "Eleventh Five -Year Plan" period, the average annual growth rate of agricultural growth was 3.28%.

& emsp; & emsp; [Industry] The main industries include textiles, food processing, chemicals, pharmaceuticals, steel, cement, mining, petroleum and machinery.Emerging industries such as automobiles, electronic products, aviation and space have developed rapidly in recent years.In the 2016/2017 fiscal year, the Indian industry production index increased by 5%year -on -year, of which the power industry increased by 5.8%, and the manufacturing and mining industry increased by 4.8%and 5.4%year -on -year.Mumbai Wealth Management

& emsp; & emsp; [service industry] In recent years, industry has achieved rapid development.The fiscal year 2015 increased by 9.7%, and the 2016/17 fiscal year increased by 7.7%.Among them, the hotel trade service industry, financial service industry, public management and other service industries increased by 7.8%, 5.7%, and 11.3%, respectively, accounting for 24%, 18.5%, 14.5%, and 7.8%, respectively.The contribution rate of the service industry in the fiscal year in 2016/17 was 62%of the total value -added of the country, becoming India's major departments to create employment, exchange and attract foreign capital.

& emsp; & emsp; [Tourism] Tourism industry is the key development industry in the Indian government and an important employment department.In recent years, the number of tourists in India has increased year by year, and tourism income has continued to increase.The main tourist spots are Agra, Delhi, Swing, Changdigal, Na Tuo, Masol, Guoa, Heidraba,

Trifan Tela and so on.

& emsp; & emsp; [Textile] The textile industry occupies an extremely important position in the national economy.The annual report shows that the textile industry contributes 4%of GDP, 14%of industrial output, and 11%of exports.The industry attracted 35 million employment, which is the second largest employment department after agriculture.The main products include cotton textiles, artificial fibers, wool products, silk fabrics, jaoseki products, handicrafts, carpets, handicrafts and garment.The main textile companies include the Indian National Textile Corporation (NTC), the Indian National Jutchion Production Corporation (NJMC), the Indian Cotton Corporation (CCI), Elgin,

Mills and Spencex.

& emsp; & emsp; [pharmaceutical industry] India's pharmaceutical scale ranks second in the global scale, and biomedicine is the leader of the Indian pharmaceutical industry.India is a global hub in the generic drug market, with a market size of the pharmaceutical industry exceeding $ 20 billion.Dives from the growth of the demand for the Asian, CIS countries and the Lajia market, in fiscal 2017, Indian drug exports were US $ 17.25 billion, an increase of 2.5%year -on -year.Due to the tightening of mainstream generic price competition and regulatory review policies, in the first 11 months of fiscal 2017/18, the export value to North America was $ 4.83 billion, a year -on -year decrease of 8.04%.

& emsp; & emsp; [Key industry] The key industries in India are mainly: the automotive industry, banking industry, capital market, health science

& emsp; & emsp; 3. water, electricity, gas priceAgra Investment

& emsp; & emsp; water, electricity, gas supply is tight, and the prices of different regions are different.

& emsp; & emsp; [Electricity] Taking New Delhi as an example, in March 2018, the portion of the family is 3 rupees per degree within 200 degrees, 4.5 rupees per count of 201-400 degrees, between 401-800 degrees per degree6.5 rupees, 7 rupees between 801-1200 degrees, and 7.75 rupees per degree or more than 1200.In areas with lack of electricity in the northwest, electricity prices may be higher than the above level.

& emsp; & emsp; commercial electricity (load below 108kva) is 7.9 rupees within 10kW, and charges a fixed cost of 100 rupees per kilowatt 100 watt per month.For fixed costs, 8.9 rupees per count of 100kW or more, and charge a fixed cost of 150 rupees per kW per month.

& emsp; & emsp; industrial electricity consumption of 7.6 rupees per kWh within 10kW, and charge a fixed cost per kilowatt 80 rupee per kilowatt, 10kW-100KW, 7 degrees of Devilizer, and charge a fixed cost per kilowatt 90 rupees per month, 100KW 100KWThe above -mentioned 8.5 rupees are charged for a fixed cost of 150 rupees per kilowatt 150 rupees per month.Agricultural electricity consumption is 2.75 rupees per degree, and charges a fixed cost of 20 watts per unit per month.

& emsp; & emsp; [Natural gas price] Taking New Delhi (NCR) as an example, compressing natural gas (CNG) 38.76 rupees per kilogram, and pipeline natural gas (PNG) with a total amount of 25.19 rupees/cubic meters within 36 cubic meters.The 47 rupees/cubic meters of 36 cubic meters.

& emsp; & emsp; [Water price] The water prices in all parts of India are large. Taking New Delhi as an example, the residents' water uses water per thousand liters per thousand liters of 5.27 rupees per month, and the monthly fixed cost is 146.41 rupees, 20-30,000 thousand thousand thousand rupees, 20-30,000 thousand thousand thousand thousandThe 26.36 rupees between the liters of liters and the monthly fixed cost of 219.62 rupees, the 43.93 rupees per thousand liters per thousand liters, and the monthly fixed cost of 292.82 rupees, in addition, per thousand

Increase 60%of the sewage treatment fee.

& emsp; & emsp; commercial/industrial water for less than 6,000 liters per thousand liters of 17.57 rupees per thousand liters per month, and charge a monthly fixed cost of 146.41 rupees, between 6-15,000 liters of 26.35 rupees, and charges monthly fixed per month.The cost is 292.82 rupees, a 35.14 rupee of 15-25 thousand liters, and the monthly fixed fee is 585.64 rupees, the 87.85 rupees of the 1,000 liters between the 25-50,000 liters, and the monthly fixed fee is 1024.87 rupees, 50-Between 100,000 liters, 140.56 rupees per thousand liters, and charge monthly fixed fees

With 1171.28, 175.69 rupees per thousand liters of 100,000 liters, and charging a monthly fixed fee of 1317.69 rupees, in addition, 60%of the sewage treatment fee per thousand liters.

& emsp; & emsp; [Oil price] In May 2018, New Delhi gasoline was 75 rupees per liter, and diesel at 66 rupees per liter.

& emsp; & emsp; 4. market access

& emsp; & emsp; [prohibited industry] nuclear energy, gambling gaming industry, risk funds, cigars and tobacco industries.

& emsp; & emsp; [restricted industry] Telecom service industry, private banking industry, multi -brand retail industry, aviation service industry, infrastructure investment, radio and television broadcasting, etc.If foreign investment exceeds the upper limit of the government's investment ratio, it is required to be approved by relevant government departments.

& emsp; & emsp; invest in business projects that retain to small enterprises, and need to be approved by the government.In order to support the development of small enterprises, the Indian government has stipulated that some industrial projects will only be operated by small enterprises since 1997.Small enterprises are generally defined as projects that are less than 50 million rupees for factories and machinery and equipment.Since 1999, the scope of the above project has been reduced. As of March 2007, 114 items are still kept (771 types of product categories are included in each item;After obtaining an industrial license, non -small enterprises can also operate industrial projects that retain them to small enterprises.

However, the export ratio of the project requires more than 50%.

& emsp; & emsp; [Encouraged industry] Electricity (except nuclear power), sales of oil refining products, mining, financial intermediaries, agricultural breeding, electronic products, computer software and hardware, special economic zone development, trade, wholesale, food processingwait.

& emsp; & emsp; 5. Main taxation

& emsp; & emsp; The Indian tax system is established based on the regulations of the Indian Constitution. According to Article 265 of the Indian Constitution: "Without the authorization of the parliament, it cannot be taxed in administrative."India's tax legislative power and the right to collect are mainly concentrated between the central government and the state, and the local city -level governments are responsible for a small amount of tax collection.

& emsp; & emsp; The tax rights of the central and state state have a clear division of tax rights.

TAXES includes two categories: direct tax and indirect tax. Direct tax is mainly composed of corporate income tax, personal income tax and wealth tax. Indirect tax mainly includes goods and labor taxes (GST) (2017)

On July 1st of the year), tariffs, etc.

& emsp; & emsp; the state government also mainly levies newly levied GST, stamp duty, Bang Consumption tax, entertainment gaming tax, land income tax, etc.In the fields where GST is not covered, such as petroleum products and liquor, it continues to levy original taxes such as value -added tax (state without value -added tax).The taxes levied by local city governments mainly include property taxes, market taxes, as well as public facilities such as water supply and drainage.

& emsp; & emsp; 6Guoabong Stock. Enterprise registration

& emsp; & emsp; In India, the form of investing in the establishment of enterprises includes four types: representative offices, branches, private limited companies, and public companies.

& emsp; & emsp; (1) on the Internet (website :) Apply for temporary directors code (DIN), fill in the digital signature (DSC) application form.Applicants will immediately accept the temporary directors' code approved

To DIN-1 (Application Form for Permanent Director).

& emsp; & emsp; (2) verify the company name with DIN and DSC.

& emsp; & emsp; (3) Drafting the company's articles of association (Memorandum) and the implementation rules (Article

Of association, clarify the company's business scope, the number of shareholders, the proportion of capital contribution, and how the board of directors is convened.

& emsp; & emsp; (4) to the company's registry (register

Of companies, ROC) submit the company's articles of association and implementation rules to apply for the "Certification of Incorporation in

India).

& emsp; & emsp; (5) engraved chapters (director seal and authorized signature seal).

& emsp; & emsp; (6) After receiving the "Company's Certificate", the "Company Articles of Association and Implementation Rules" is printed (put Coi on the homepage).

& emsp; & emsp; (7) to UTI

Investors Services Limited

Acountnumber, Pan, also known as "tax number").UTI handles this application on behalf of the Indian Tax Department.

& emsp; & emsp; (8) open account accounts to the bank.

& emsp; & emsp; (9) Assessing

Office in the Income Tax Department) Apply for tax code (TAX Account Number for Income Taxes

Deducted at Source, TAN code).

& emsp; & emsp; (10) If the company's main import and wholesale trade, you need to apply for import and export code (IEC

CODE) and TIN (TAX IDENTIFICATION NUMBER), which represents the central sales tax and local sales tax (requiring 100,000 rupee bank insurance letter).

& emsp; & emsp; If the company's main service industry, you need to apply for a service tax number (service

Tax number).

Article Address: http://lseshc.com/FI/40.html

Article Source:Admin88

Notice:Please indicate the source of the article in the form of a link。